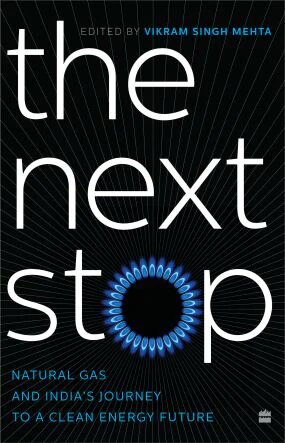

Book Excerpt: The Next Stop | How is natural gas pricing done in India?

Book Excerpt: The Next Stop | How is natural gas pricing done in India?on Apr 15, 2021

A new book edited by energy expert Vikram Singh Mehta looks at different aspects of natural gas use in India, including policy changes and reforms in pricing.

The pricing of domestic gas in India has been a contentious issue for several years, with domestic pricing reform undergoing several reconfigurations. At first glance, gas pricing in India appears notoriously complicated. There are a variety of different prices at the well head.

To put it in simple terms, for many years the price of domestic gas to producers was set according to the terms of the fiscal regime that governed a specific producing field. India has had multiple fiscal regimes in place at different points in time—including the ‘nomination regime’, the pre-New Exploration Licensing Policy (pre-NELP) regime, the NELP and the Hydrocarbon Exploration Licensing Policy (HELP; the ruling regime which now includes an ‘open acreage’ licensing system)—therefore a multitude of prices have existed simultaneously. Transportation costs, marketing margins and Central and state taxes were then added to this well-head price to obtain the delivered price for gas. As states have considerable fiscal autonomy over indirect taxation, these tax rates have tended to vary across states.

Must Read - 10 extraordinary children’s books

There have been numerous attempts at reforming domestic gas prices. The latest configuration of domestic gas pricing reform, implemented in October 2014, has broken with the previous system (which was based on oil price linkages), with a linkage to a twelve-month trailing (with a lag of one quarter), physical volume-weighted average of four international ‘benchmark’ gas prices—the US Henry Hub price, the UK National Balancing Point (NBP) price, the Russian domestic gas price and the (Canadian) Alberta reference price for gas. Transportation tariffs and indirect taxes are then applied as before. The formula is adjusted bi-annually and although this simply adds to the multitude of pricing regimes for domestic gas, previous regimes are expected to eventually converge to this new pricing regime.

on price levels as opposed to pricing mechanisms.

-

- How should domestic gas be priced for the Indian market?

-

- What are some of the key trade-offs that policymakers face in gas pricing and what are the underlying distortions?

-

- Is there a general framework of guiding principles for natural gas pricing that can be applied to the Indian market?

-

- Sustainability: The price should enable a regulated company to finance its businesses and new investment required for future operations.

-

- Efficiency: The price should act as a signal that incentivizes consumers to use the amount of resources that are efficient for the system.

-

- Equity: An equitable price does not unduly discriminate against one group of consumers in service provision and cost allocation.

-

- Transparency: The price should be communicated (e.g., published) in clear and understandable terms.

-

- Simplicity: The price should be easy to understand and accept.

-

- Stability: The price should be based on a calculation methodology that is consistent over time.

-

- Consistency: The price should be coherent with the industry structure and regulatory framework in place in the country at any given time.

Book Excerpt

Book Review

domestic gas prices

Frontlist Latest Update

Frontlist News

The Next Stop

Vikram Singh Mehta

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Sorry! No comment found for this post.